Official Let's Make Some Money Off Stocks Thread

#571

Originally Posted by dyu626,Aug 7 2008, 11:07 AM

Originally it was a long term investment, but now that its tanked so much, I figured money can be put to better use elsewhere.

Thanks for the advice trainwreck. Gives me confidence in putting a stop-loss.

From now on I'm putting a stop-loss on all my trades lol, so I don't let them get to this point of double digit losses.

Thanks for the advice trainwreck. Gives me confidence in putting a stop-loss.

From now on I'm putting a stop-loss on all my trades lol, so I don't let them get to this point of double digit losses.

YGE is ripping me a new A hole but I bought it as a gamble with high rewards and big risk. You cannot always guess a bottom. Buy the companies you like at the current low price and stick with it.

My portfolio is currently at 7% cash. Most of my holdings right now are in AAPL, YUM, BMO and a few more. I'm a longterm investor but will take profits from my holdings if I see a 15% return.

I think tech is going to be a good hold throughout the fall season. Look at today. The DOW is down 228 points and rimm and AAPL are only down .22%

#573

The pumpers at CNBC are annoying.

Yippee...... gold and oil are down and the dollar is up, all of our problems have been corrected. Market is going back to 14,000.

For the past couple weeks that is all they have been saying day after day.

Yippee...... gold and oil are down and the dollar is up, all of our problems have been corrected. Market is going back to 14,000.

For the past couple weeks that is all they have been saying day after day.

#575

I will load up on energy gathering/extracting stocks very soon...whenever we bottom.

Fundamentals have not changed and will be GREAT investments for the long term investor.

I made most of my money buying in large quantities when oil pulled back to $50/barrel last time.....I will make just as much this time around when oil pulls back this time.

dabble in wind/solar/coal/ng/uranium miners/energy services.

very underpriced at current prices. accumulate for long term.

Can energy systems go down further....of course.......but markets will not go down forever.....and the cheaper prices get.....the more energy wasteful people become....and when the tide turns....energy consumption will increase.....and if supply continues to remain flat or decline for oil.....price increases of all energy will increase.

I am a buyer all fall long

Fundamentals have not changed and will be GREAT investments for the long term investor.

I made most of my money buying in large quantities when oil pulled back to $50/barrel last time.....I will make just as much this time around when oil pulls back this time.

dabble in wind/solar/coal/ng/uranium miners/energy services.

very underpriced at current prices. accumulate for long term.

Can energy systems go down further....of course.......but markets will not go down forever.....and the cheaper prices get.....the more energy wasteful people become....and when the tide turns....energy consumption will increase.....and if supply continues to remain flat or decline for oil.....price increases of all energy will increase.

I am a buyer all fall long

#576

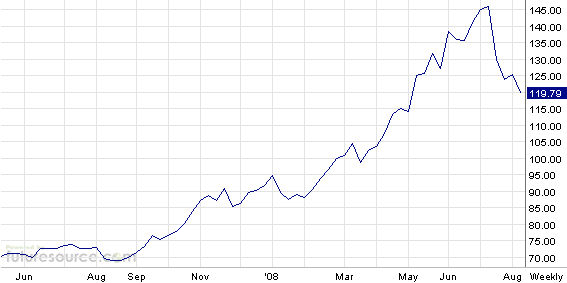

What are we to make of the rapid decline in oil prices from over $147 to under $120? I have been a long-time bull on oil and commodity prices, and a bear on the financials. Is this trade, which has been so profitable over the last few years finally over? Is it time to reverse course? I think not.

The key reason for the decline in oil (and other commodity) prices recently is due to spreading economic weakness around the globe. Japan has indicated that it is falling back into recession, Western Europe is weak, and there are even indications that China's growth is slowing (although to a rate that any other country would envy, like to 9.0% or so). There has been relatively little happening on the supply front.

The oil market is one that has very inelastic curves for both supply and demand. This means that small shifts in either can lead to large price changes. All indications are that the changes are mostly on the demand front. In the U.S. drivers have cut back on the number of miles they drive by about 3%, and they are starting to drive in more fuel-efficient ways. They are even starting to check their tire pressure! Contrary to some assertions of the political chattering class, that actually makes a difference, and a difference that is felt today, not seven years from now like increased offshore drilling might.

A major question is, if part of the cure for high prices has been high prices, i.e. $4 a gallon gas has forced people to change their behavior, will lower prices again cause higher prices? Will people start to take their big SUV's out of the garage again? Will they start to accelerate quickly away from the stop light again? Probably not immediately, but in time they will. We will become accustomed to the current slightly lower prices and go back to our old ways.

We have started to see some of the structural changes in the economy that are needed to cut into energy usage in a rational and relatively painless way. Sales of big SUV's are down, while there a long waiting lists for more fuel-efficient vehicles. However, given the size of the overall fleet, these changes will have to be sustained for several years to make a real difference.

While China may be slowing slightly, the growth there is not going to come to a halt, nor will it in India. There have been no major breakthroughs on the supply front and the incremental oil is still going to come from very expensive and difficult places. With growing demand and limited supply over time, some of that demand has to be destroyed.

High prices are the great destroyer of demand. To the extent that demand can be destroyed relatively painlessly (i.e. proper tire inflation, switching to more efficient light bulbs) it reduces the need for demand to be destroyed painfully (people freezing to death in New England this winter, starvation in the third world). However, one way or another demand will be destroyed. Honestly, I do not know which direction the next $10 in oil prices will go. However, I am extremely confident that the next $50 move in oil will be to the upside.

http://biz.yahoo.com/zacks/080807/14095.html?.v=1

I agree...makes sense to me. Fundamentals have not changed

The key reason for the decline in oil (and other commodity) prices recently is due to spreading economic weakness around the globe. Japan has indicated that it is falling back into recession, Western Europe is weak, and there are even indications that China's growth is slowing (although to a rate that any other country would envy, like to 9.0% or so). There has been relatively little happening on the supply front.

The oil market is one that has very inelastic curves for both supply and demand. This means that small shifts in either can lead to large price changes. All indications are that the changes are mostly on the demand front. In the U.S. drivers have cut back on the number of miles they drive by about 3%, and they are starting to drive in more fuel-efficient ways. They are even starting to check their tire pressure! Contrary to some assertions of the political chattering class, that actually makes a difference, and a difference that is felt today, not seven years from now like increased offshore drilling might.

A major question is, if part of the cure for high prices has been high prices, i.e. $4 a gallon gas has forced people to change their behavior, will lower prices again cause higher prices? Will people start to take their big SUV's out of the garage again? Will they start to accelerate quickly away from the stop light again? Probably not immediately, but in time they will. We will become accustomed to the current slightly lower prices and go back to our old ways.

We have started to see some of the structural changes in the economy that are needed to cut into energy usage in a rational and relatively painless way. Sales of big SUV's are down, while there a long waiting lists for more fuel-efficient vehicles. However, given the size of the overall fleet, these changes will have to be sustained for several years to make a real difference.

While China may be slowing slightly, the growth there is not going to come to a halt, nor will it in India. There have been no major breakthroughs on the supply front and the incremental oil is still going to come from very expensive and difficult places. With growing demand and limited supply over time, some of that demand has to be destroyed.

High prices are the great destroyer of demand. To the extent that demand can be destroyed relatively painlessly (i.e. proper tire inflation, switching to more efficient light bulbs) it reduces the need for demand to be destroyed painfully (people freezing to death in New England this winter, starvation in the third world). However, one way or another demand will be destroyed. Honestly, I do not know which direction the next $10 in oil prices will go. However, I am extremely confident that the next $50 move in oil will be to the upside.

http://biz.yahoo.com/zacks/080807/14095.html?.v=1

I agree...makes sense to me. Fundamentals have not changed

#577

Administrator

Thread Starter

Originally Posted by lOOkatme,Aug 7 2008, 09:26 PM

Fundamentals have not changed

if oil traded on fundamentals but alas it does not. Oil is a technical trade and if you want to swim with the sharks in the oil pits you better know how to read a chart. Oil is now in a bear market cycle.

There are two key disciplines to trading: 1) buy when things look shit and b) sell when things look rosy. You may be overstaying your welcome which means riding the elevator all the way down to P3.

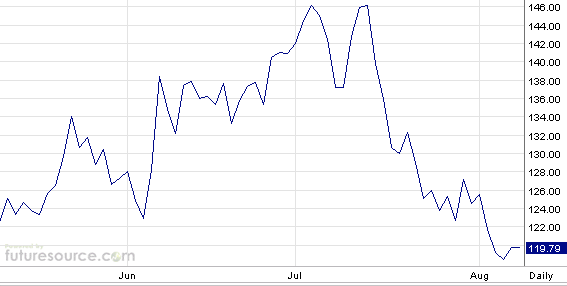

The problem is that the rally failed with a 145 handle and formed a double top. When breaking out past a previous high fails the technical trade is to go back and test for support.

As you can see there is no support until it hits $90. This is where the $90 oil price you hear quoted by some analysts comes from. They expect oil to test this range and so do I.

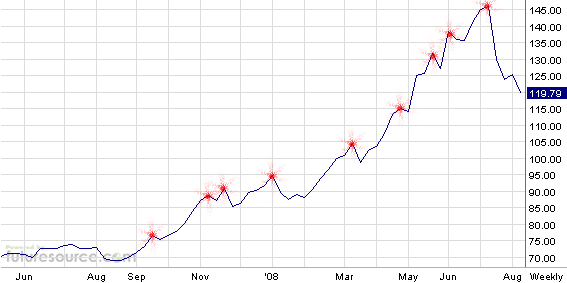

I would not be a buyer of oil again until it dips below $95 and then breaks through it again. Resistance will come at $95. The technical elements are pretty simple. If you look at the second chart you'll see that each high was higher than the last.

On the way down you'll see lower highs meaning that if it rallies at all it won't break out past its previous high until it hits the floor. From here it's not going to rally past 127 before legging down below 118 again. Thats if it rallies at all. It may well just continue down, especially with EU interest rates peaking and the dollar on the move up.

You can see from the first daily chart that it tried to find support at 123, where it did before it peaked, and failed. It will continue to bounce down. The next stop is 115 then 100 then 90.

Good luck

#579

Registered User

Join Date: Mar 2005

Location: Hammonton, NJ

Posts: 637

Likes: 0

Received 0 Likes

on

0 Posts

What do you guys think of WFMI. Whole Foods just cut their outlook and eliminated their dividend. It went down 15% on tuesday. As an investor I am tempted to do the old...

"Buy when things look like crapola"

But I dont know if this company has the long term growth/fundamentals to rise back to the 53 dollars it used to be at.

Anyone see the writting on the wall or see something in the fundamentals that says screaming buy or overpriced? Thanks in advance for the opinions.

"Buy when things look like crapola"

But I dont know if this company has the long term growth/fundamentals to rise back to the 53 dollars it used to be at.

Anyone see the writting on the wall or see something in the fundamentals that says screaming buy or overpriced? Thanks in advance for the opinions.